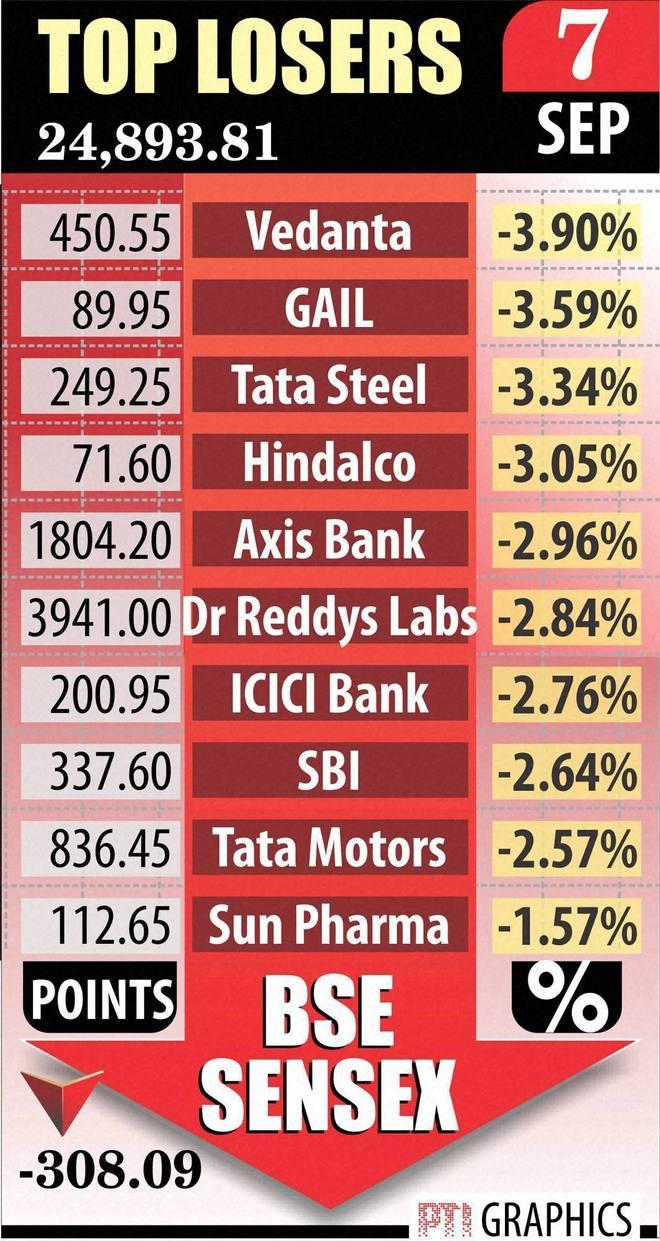

Continuing its downward slide, the BSE Sensex fell below the psychologically important 25,000-level today after crashing 308 points to 24,893 points, its lowest closing in 15 months, while the rupee fared even worse falling to a 2-year low.

The market selloff was on account of reports of a deficit monsoon and rupee falling to a fresh two-year low, while continued selling on China-fuelled worries also weighed.

During the day, the rupee fell to 66.82 against the US dollar, a fresh 2-year low. The selling spree in the Chinese markets added to the weak sentiment.

Vinod Nair, Head-Fundamental Research, Geojit BNP Paribas Financial, said India was earlier being secluded from global concerns in expectation of reforms. “But as the reforms got derailed, India’s outperformance over the other EMs is narrowing fast. The Indian equity market is very sensitive to FII inflows which are currently concerned about the US rate hike decision which is likely next week”, he added.

According to a report by Bank of America Merrill Lynch, markets will continue to see volatility till markets price in three expected event risks in September-November which are the US Fed action, earnings turnaround and Bihar polls.

“Our US economist, Ethan Harris, continues to expect the Fed to hike interest rates on September 17, on improving US data, although market turmoil poses a risk”, the research note said.

It noted that the Bihar poll results, out by November, will impact the market’s perception of reforms. “It is another matter that we think lending rate cuts are far more critical for cyclical recovery at this point than “reforms”, the report said.

The report said portfolio flows stalling is not as much a macro worry as a market risk. “Our BoP estimates suggest that the capital account surplus can fund our expected current account deficit of 1.3% of GDP even without FPI inflows, as risk off is also pulling down oil prices”, it said.

The report said a $10/barrel fall narrows the current account deficit by about $8bn or 0.4% of GDP.

On the link between the Sensex and foreign inflows, the report has highlighted that equities typically struggle if FPI inflows dry up at rich valuations.